todays markets

market news

🩸dow drops more than 350 points to end brutal week, S&P 500 closes in correction territory.

😡gemini files complaint against genesis over $1.6 billion in GBTC shares.

🪖9 protocols criticize layerzero’s wstETH token, claiming it’s ‘proprietary’.

🚀spot crypto trading volumes surge to levels not seen since March.

💱uniswap DAO temperature check shows support for investing $12 million of UNI for 20% share in ekubo's future governance token.

crypto fear and greed index

🔊 market event to look out for (UTC times)

tuesday (31/10)

01:30 CNY - manufacturing PMI (oct) - forecast: 50.4

02:30 JPY - BoJ interest rate decision - forecast: -0.1%

10:00 EUR - CPI (YoY) - forecast: 3.2%

14:00 USD - CB consumer confidence (MoM) - forecast: 100

wednesday (1/11)

14:00 USD - ISM manufacturing prices (oct) - forecast: 44.9

14:00 USD - JOLTs job openings (sep) - forecast: 9.27m

14:00 USD - fed interest rate decision - forecast: 5.5%

thursday (2/11)

12:00 GBP - BoE interest rate decision (nov) - forecast: 5.25%

friday (3/11)

10:00 EUR - unemployment rate (sep) - forecast: 6.4%

12:30 USD - unemployment rate (oct) - forecast: 3.8%

around the X-verse… (formerly the twitterverse)

what. a. week! 😀

tradFi making the calls 🎯…

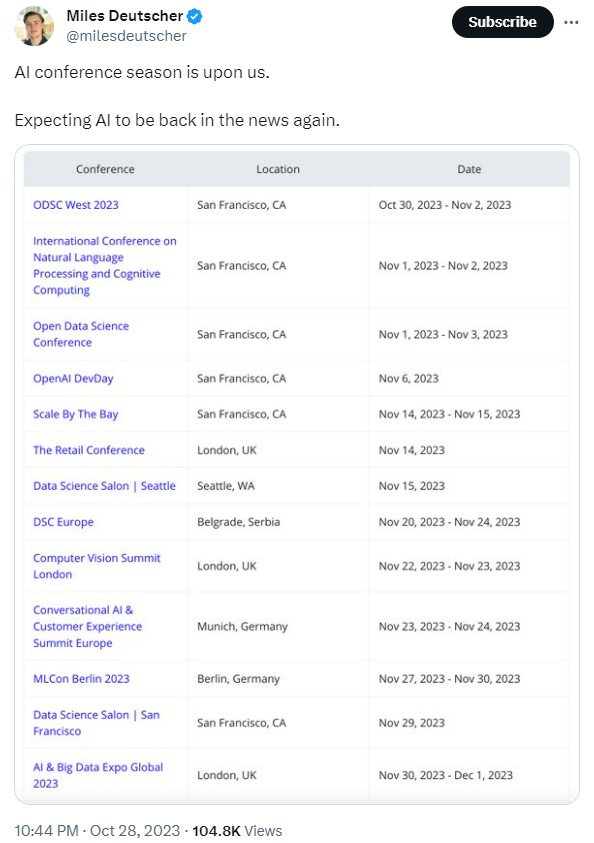

AI szn is upon us (again) 🤖…

trade ideas

trade: long IXIC/ USD

The nasdaq (IXIC) has exhibited a pattern of lower highs since hitting its 2023 peak around ~14,450 in July.

now, with its recent break below the former lows of ~13,080, it could lead to a potential decline towards the previous significant resistance mark of around ~12,270.

should the price revisit this level, it could offer a substantial support, and possibility for a rebound. if, upon reaching this price point, it holds firm without breaking the support, it might be an time to consider initiating a LONG position.

#NFA #DYOR

website: handle.fi

twitter: twitter.com/handle_fi

discord: discord.com/invite/nbSdYCDGhh