todays markets

market news

💵paypal launched a new off-ramp service to convert crypto tokens to USD directly.

🏦franklin templeton has become the latest traditional finance giant to join the spot bitcoin ETF race.

💰crypto exchange bitget establishes $100M pot to fund ecosystem growth.

📉nasdaq closes lower by 1% tuesday as apple slides and tech suffers.

🛢️WTI crude holds near yearly highs on supply cuts and upbeat chinese data

crypto fear and greed index

🔊 market events to look out for (UTC times)

wednesday (13/9)

economic

06:00 GBP - GDP (MoM): forecast -0.2%

12:30 USD - CPI (MoM): forecast 0.6%

12:30 USD - core CPI (MoM): forecast 0.2%

crypto

FTX liquidation approval (pending court ruling)

Token2049 conference begins

learning with zAIus 📚

CPI results

the consumer price index (CPI) measures inflation.

when CPI rises, central banks may increase interest rates to curb inflation. higher interest rates can attract foreign capital, boosting a country's currency value in the forex market. conversely, a high CPI may weaken a currency as it erodes purchasing power.

forex traders closely watch CPI data to anticipate currency and interest rate movements. in short, CPI influences interest rates, which in turn impact forex rates

around the X-verse… (formerly the twitterverse)

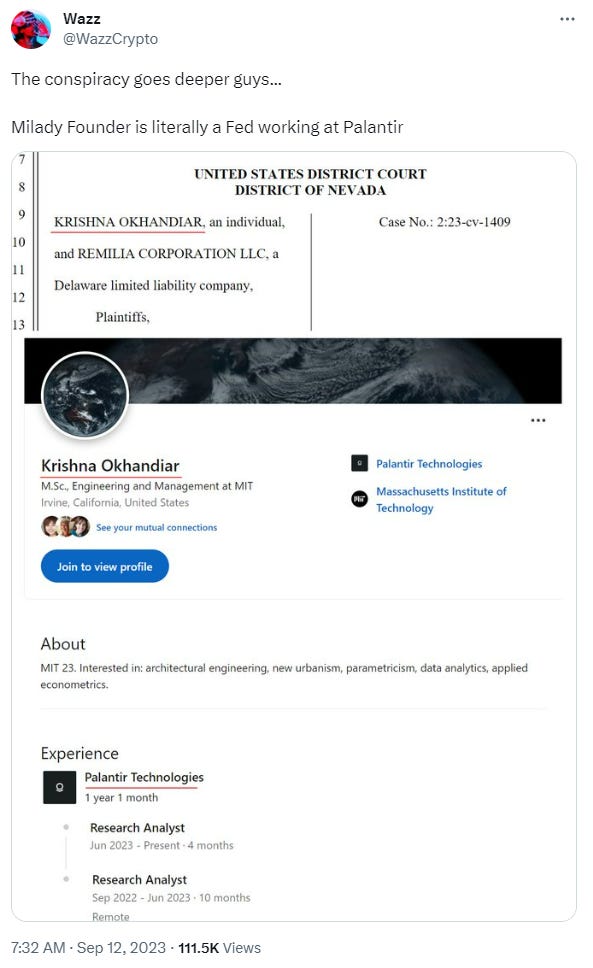

art of the deal? 🤝…

like wot the 🤯…

another one bites the dust 😔…

trade ideas

trade: long ETH/ BTC

aside from a few outliers, ETH/ BTC has remained within a range between ~0.0604 & ~0.0644 for more than 2 months.

in the recent market sell off, the ETH/ BTC ratio returned to the bottom of its range, bouncing off possible support. it could be an opportune time to initiate a LONG on a retest of support ~0.604. a target for the trade would be the top of the range ~0.0644. if price is to drop below support then that could lead to downside expansion. #NFA #DYOR

website: handle.fi

twitter: twitter.com/handle_fi

discord: discord.com/invite/nbSdYCDGhh