todays markets

market news

💥nasdaq closes higher monday to notch longest winning streak since january.

💷london stock exchange seeks digital assets director with a passion for digital assets, crypto and blockchain.

🖨️arbitrum community approves initial vote on proposal to activate token staking.

🏦XRP spikes 10% as several institutions adopt ripple’s services.

🪙U.S. treasuries spearhead tokenization boom in RWA.

crypto fear and greed index

trooperNotes: reserve bank of oztralia (RBA) 📚

the reserve bank of australia (RBA) is australia's central bank and primary monetary authority. it oversees the country's monetary policy, including the issuance and regulation of currency. a crucial aspect of the RBA's function is the assessment of the official interest rates, which is conducted on the first tuesday of every month. these decisions on interest rates are pivotal as they influence inflation and the economy's health by affecting the cost of borrowing. market and economic analysts closely watch these assessments, which can impact everything from mortgage rates to the strength of the Australian dollar.

the next announcement is due at 03:30 GMT on tuesday, with forecasts suggesting an increase in the cash rate from 4.1% to 4.35%, which could have significant implications for financial markets and consumer spending.

around the X-verse… (formerly the twitterverse)

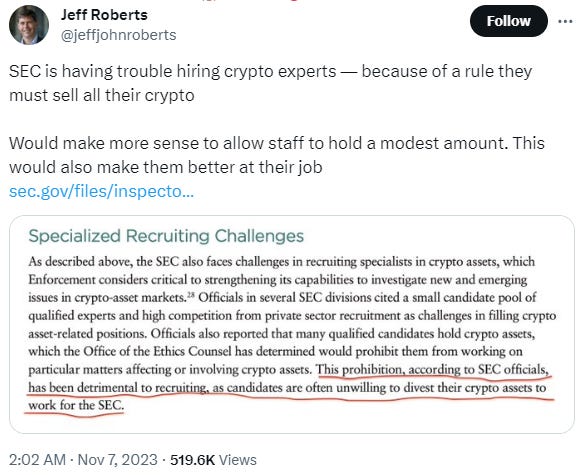

anyone surprised? 🙄…

as certain as death and taxes…? ⚖️…

hope springs eternal 🙏🏼…

trade ideas

trade: short WTI/ USD

oil prices have slipped under the ~83 mark, a level that had previously capped the price in 2023 before september.

this price acted as a ceiling, with oil swinging between it and the support level near ~66. with prices back in this range, it may suggest an opportunity to consider initiating a SHORT trade. the potential target could be the bottom of the range with a possible stop loss above the ~83 mark.

#NFA #DYOR

website: handle.fi

twitter: twitter.com/handle_fi

discord: discord.com/invite/nbSdYCDGhh