todays markets

market news

😐S&P 500 closes slightly lower as traders brace for friday’s big jobs report.

🔬oil’s slump deepens below $US85 with demand under the microscope.

🧑🤝🧑social protocol stars arena takes on friend.tech while boosting AVAX.

🤏🏼crypto fundraising hits 3-year low as firms struggle to raise capital: messari.

🪄FTX insider gary wang: sam bankman-fried allowed alameda to withdraw unlimited funds.

crypto fear and greed index

🔊 market event to look out for: non-farm payroll

the nonfarm payrolls report, which provides monthly data on U.S. employment excluding agricultural jobs, is in the spotlight as wall street braces for potential market shifts. the resilience of the recent labor market has raised concerns. if the labor market remains strong, the federal reserve might sustain higher interest rates, potentially affecting the U.S. economy at a crucial juncture. dow jones surveys predict 170,000 new jobs for september, but higher numbers could unsettle the market.

recent trends have shown a drop in weekly jobless claims, signaling employers' hesitation to reduce payrolls. the prevalent notion is that in uncertain economic times, employers might slow hiring but aren't necessarily looking to reduce workforce size just yet. if Friday's results echo strength, the markets might be in for another jolt.

around the X-verse… (formerly the twitterverse)

numba go up 📈…

can devs do something..pls 🆘…

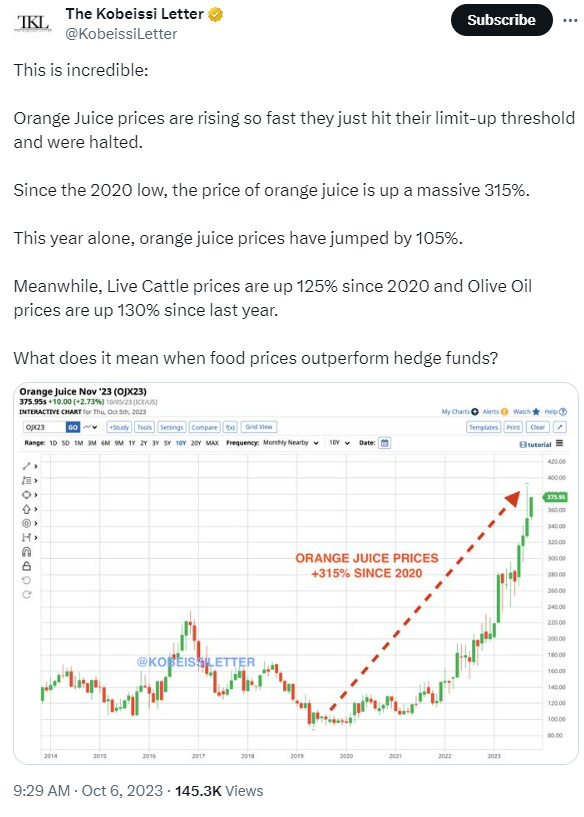

so this is where all the volatility is hiding!! 🤬…

trade ideas

trade: long AUD/ USD

over the past weeks, the aussie dollar had predominantly hovered within the ~6520 =>.6360 range. however, a noticeable shift was seen when the price fell outside the range; touching lows near ~0.629.

currently, with the currency having rebounded above the range low - and back in range - there's an expectation of it possibly returning to its previous range trading.

if this pattern holds true, there's potential for a movement back towards the upper resistance, set at ~.652. traders might find this a moment to consider initiating a LONG position, targeting this resistance level.

however, as with all trades, it's crucial to be prepared for any eventualities. therefore, setting a strict stop loss at ~0.632 could be considered prudent.

for those looking to broaden their understanding of range trading strategies, we recommend reading our most recent thread.

#NFA #DYOR

website: handle.fi

twitter: twitter.com/handle_fi

discord: discord.com/invite/nbSdYCDGhh