todays markets

market news

💥dow jumps more than 550 points for best day since june as bond yields recede.

💪🏼coinbase beats Q3 estimates, USDC interest income rebounds to $172 million.

🤏🏼GBTC discount narrows to 23-month low on ETF conversion hopes.

📜paypal subpoenaed by SEC over its PYUSD stablecoin, due to regulators' concerns.

🐄argentina presidential hopeful wants to mine bitcoin from 'dead cow'.

crypto fear and greed index

trooperGlossary: nonfarm payrolls 📚

nonfarm payroll figures are a critical economic indicator representing the total number of paid U.S. workers of any business, excluding general government employees, private household employees, employees of nonprofit organizations that provide assistance to individuals, and farm employees.

these figures, set to be released at 12:30 UTC, are a vital sign of economic health and have significant implications for the economy and foreign exchange markets. with forecasts predicting a figure of 188k for october, down from the previous month's robust 336k, this decline suggests a potential slowdown in the labor market. this slowdown could signal a cooling of economic activity, possibly leading to a more cautious federal reserve stance.

in the FX market, such data can create volatility; a lower-than-expected number could weaken the U.S. dollar as traders might speculate on a less aggressive rate hike policy to sustain employment growth. conversely, if the figures surprise to the upside, the greenback could rally on expectations of continued economic strength and a more hawkish Fed policy.

around the X-verse… (formerly the twitterverse)

another indicator for the win! 💪🏼…

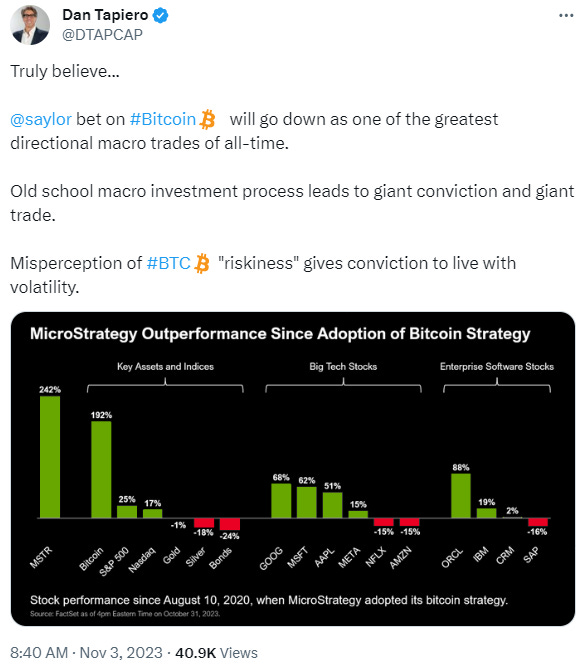

becoming hard to argue with 🚀…

gotta respect the pump 🏋🏼♂️…

trade ideas

trade: short AUD/ USD

the australian dollar recently experienced a notable rebound from its range bottom near ~0.628, rallying to the upper range limit of approximately ~0.645.

however, the currency faced resistance and failed to break through on its initial attempt. this resistance suggests that it could be worth exploring a SHORT position on the australian dollar, provided it remains below the upper range boundary. a prospective trade may aim for the range's lower boundary at around ~0.628 as the target.

#NFA #DYOR

website: handle.fi

twitter: twitter.com/handle_fi

discord: discord.com/invite/nbSdYCDGhh